中欧国际工商学院教授、中国人民银行调查统计司原司长盛松成在接受美国国际市场新闻社采访时表示,中国第三季度GDP增长可能会超出预期。央行社会融资规模的数据显示,中国经济在8月份触底。

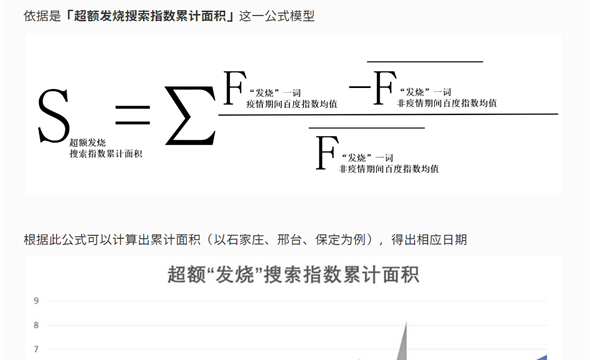

国家统计局周三将公布三季度经济数据。市场预计,三季度GDP有望同比增长为4.5%。盛松成指出,今年8月末,社融存量同比增长9%,增速比上月提高0.1个百分点,在主要金融指标中率先触底回升,结束了连续数月的放缓。

“目前社融增速在一定程度上表明经济企稳回暖,三季度经济表现可能超预期。” 盛松成指出,“9月末,社融存量同比增速继续保持在9%。由于今年GDP增速预期目标为5%左右,物价较低,三季度社融平均增速9%已经不低。”中国官方多次指出要”保持社融增速同名义GDP增速基本匹配"。

盛松成表示,我国消费逐步恢复、投资不断增加,但经济回升仍需要一定时间,逆周期调控力度不宜减弱。“货币政策还需要一定程度的宽松,未来降准降息的空间仍然存在,但降准优于降息。降准将增加商业银行的流动性,来配合财政发债,同时支持实体经济发展。” 他建议。

社会融资规模

作为中国独创的金融指标,社会融资规模内涵非常丰富,不仅包括信贷,还包括表外融资、直接融资等。 市场近期对社融讨论较多,主要是关于在货币政策持续宽松,流动性合理充裕,信贷保持高位的背景下,社融增速却表现一般。

对此,盛松成解释说,社融增速主要取决于货币政策,但后者不是唯一的决定因素,和财政政策以及金融市场的运行也有很大关系。

他指出,9月社融增长也能反映我国房地产市场的逐步企稳。房地产政策放松会增加购房者贷款,如9月居民部门中长期贷款同比多增2014亿元;也会适度提高房企融资,如银行贷款、债券融资等。这些都包括在社融中,所以社融也会增长,盛松成表示。

根据中国人民银行数据,初步测算,中国宏观杠杆率第二季度跃升至290%。盛松成表示,在经济复苏回暖时期,宏观杠杆率有所提升是正常现象,而随着经济增长,宏观杠杆率会趋稳甚至下降,所以目前我国宏观杠杆率有所提升是阶段性的而不是趋势性的。

目前居民消费在逐渐恢复,而没有趋势性下滑。国家已经并将继续采取一系列措施,促进消费增长,最根本的是发展经济、增加就业、提高收入,他强调。

MNI INTERVIEW: China GDP To Beat Expectations- Ex PBOC's Sheng

—Aggregate financing to the real economy data indicates Chinese growth touched bottom in August, according to a former high-ranking official.China’s third quarter gross domestic product growth is likely to beat expectations after central bank data on aggregate financing to the real economy (AFRE) signaled that the economy's expansion hit bottom in August, a former high-ranking People’s Bank of China official told MNI.

Investors expect Wednesday’s release to show that GDP growth printed at 4.5% year-on-year in Q3, down from Q2’s 6.3%, but Sheng Songcheng, former head of the PBOC’s statistics department, noted that AFRE rose by 9%y/y in August, up 0.1 percentage point from July and ending five consecutive months of slowdown since April.

“Outstanding AFRE grew by 9% y/y as of the end of September, which is not low considering the GDP target is around 5% and inflation remains tepid,” Sheng said, referring to the official target of “maintaining AFRE growth in line with the expansion rate of nominal GDP.”

However, Sheng, now a professor at the China Europe International Business School in Shanghai, said the PBOC should retain its easing bias as recovering consumption and rising investment would take time to feed into an economic rebound. There is still space for cuts in interest rates and reserve requirement ratios, he said.

“RRR reduction would be a better option since it can add liquidity for commercial banks and support government bond issuance,” he said, noting the significant role of government borrowing in growth in AFRE.

AGGREGATE FINANCING

An indicator unique to China, the 13-year-old AFRE gauges bank loans as well as off-balance-sheet funding and equity financing. Local investors have noted the measure’s relative weakness in recent months, despite PBOC easing, but Sheng said that fiscal and financial market activities affect the AFRE too.

Medium- and long-term loans to households added CNY201.4 billion to September’s AFRE versus the same period last year, indicating recent moves to relax controls on house buying have worked, Sheng said. Adjustments to housing policy will also boost developers, increasing their bank loans and bond sales, he said.

“The property-related items in AFRE indicate the housing market is stabilising,” Sheng said.

As to China’s rising debt/GDP ratio, which jumped to 290% in Q2 according to the PBOC, Sheng said this move higher would be temporary and the ratio will steady with economic recovery. Authorities will continue to drive for economic expansion, increases in employment and to improve household income to bolster consumption, he said.